Does Elon Musk Pay Taxes? Unpacking The Billionaire's Tax Bill

The question of whether billionaires, particularly someone as prominent as Elon Musk, truly pay their fair share of taxes is a topic that, you know, often sparks quite a lot of discussion. It's a query that seems to pop up a lot, especially when we consider the vast amounts of wealth these individuals accumulate. Many people, it seems, feel a certain way about how the very rich manage their money when it comes to obligations to the government, and this feeling is, like, pretty strong for a lot of folks.

There's a common belief out there, you see, that individuals like Elon Musk manage to avoid paying taxes entirely, or at least a significant portion of what they might otherwise owe. This idea, however, is a bit more nuanced than it first appears, as a matter of fact. He does, in fact, pay taxes, especially when he decides to sell off some of his company shares, which can lead to a really big tax event.

So, what's the real story behind Elon Musk's tax payments? We're going to take a closer look at his actual tax payments, some of the legal strategies that are out there for wealthy people, and how his status as a billionaire actually shapes what he ends up owing the tax authorities. It's a pretty interesting picture, you know, when you start to pull back the layers.

Table of Contents

- Who is Elon Musk?

- The Big Question: Does Elon Musk Pay Taxes?

- Unpacking the Numbers: What the Data Shows

- How Billionaires Manage Their Taxes: Legal Strategies

- The Public Reaction and Musk's Response

- Frequently Asked Questions

Who is Elon Musk?

Before we get too deep into the tax situation, it might be helpful to, like, just quickly touch on who Elon Musk is. He's a pretty well-known figure, obviously, but knowing a little about his background helps set the stage for why his tax payments are such a big deal. He's known for leading companies that are, you know, really pushing the boundaries in technology and space.

Personal Details and Bio Data

| Full Name | Elon Reeve Musk |

| Born | June 28, 1971 |

| Nationality | South African, Canadian, American |

| Known For | CEO of Tesla, SpaceX, X (formerly Twitter) |

The Big Question: Does Elon Musk Pay Taxes?

So, let's get right to the heart of the matter: Does Elon Musk pay taxes? This is the core question that, you know, many people are really curious about. The simple answer is yes, he does pay taxes. However, the way he and other people with a lot of money pay taxes is often quite different from what most everyday people experience, and that's where, like, a lot of the confusion comes from.

The Perception Versus Reality

The belief that Elon Musk pays no taxes at all is, frankly, a bit misleading. He absolutely does pay taxes, particularly when he sells off parts of his stock holdings, which can trigger substantial tax obligations. But, and this is a really important part, he and many other billionaires use a combination of borrowing money and other financial strategies that, in a way, help them manage what they owe the government. It's a complex system, to say the least.

To many, it just feels like something isn't quite right. When you hear about someone's wealth growing by billions, yet their reported income tax seems relatively small, it can create a sense of unfairness. This feeling is, like, a significant sticking point for a lot of people who work hard and see a large chunk of their own earnings go to taxes every payday, you know?

His Claim: A Massive 2021 Tax Bill

Elon Musk himself has, rather interestingly, often mentioned that he would pay more in federal taxes for the year 2021 than anyone has ever paid before. He estimated this amount to be around $11 billion. This claim, which he has, you know, sometimes shared as a kind of boast or perhaps a complaint, certainly caught a lot of attention. In December 2021, he actually tweeted that he would pay approximately $11 billion in taxes that year, which could be the largest individual tax payment in U.S. history, and many people, you know, wonder if he really paid that much.

Unpacking the Numbers: What the Data Shows

To really understand the situation, we need to look at some of the actual figures and analyses that have come out. It's not just about what someone says they're going to pay; it's about what the records show, too. This is where, like, independent investigations really shed some light on things.

ProPublica's Revelations: 2014-2018

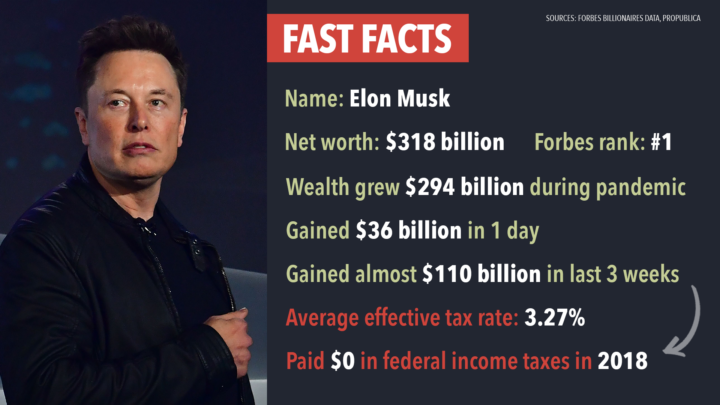

An investigation carried out by ProPublica, a reputable news organization, looked into IRS records and found some pretty interesting things. According to their analysis, Elon Musk paid no federal income taxes in the year 2018. This revelation, you know, certainly raised some eyebrows. It wasn't just him, either; the investigation also found that other very wealthy individuals, such as Jeff Bezos and Michael Bloomberg, also legally paid zero in income taxes in 2018. This suggests a pattern, you know, among the ultra-rich.

The report also pointed out that Tesla CEO Elon Musk skipped paying federal income taxes in 2018, according to their findings. This detail, like, further fueled the public discussion about how the tax system works for those at the very top. It's a situation that, in some respects, highlights how different the rules can seem for different groups of people.

Wealth Growth Versus Reported Income

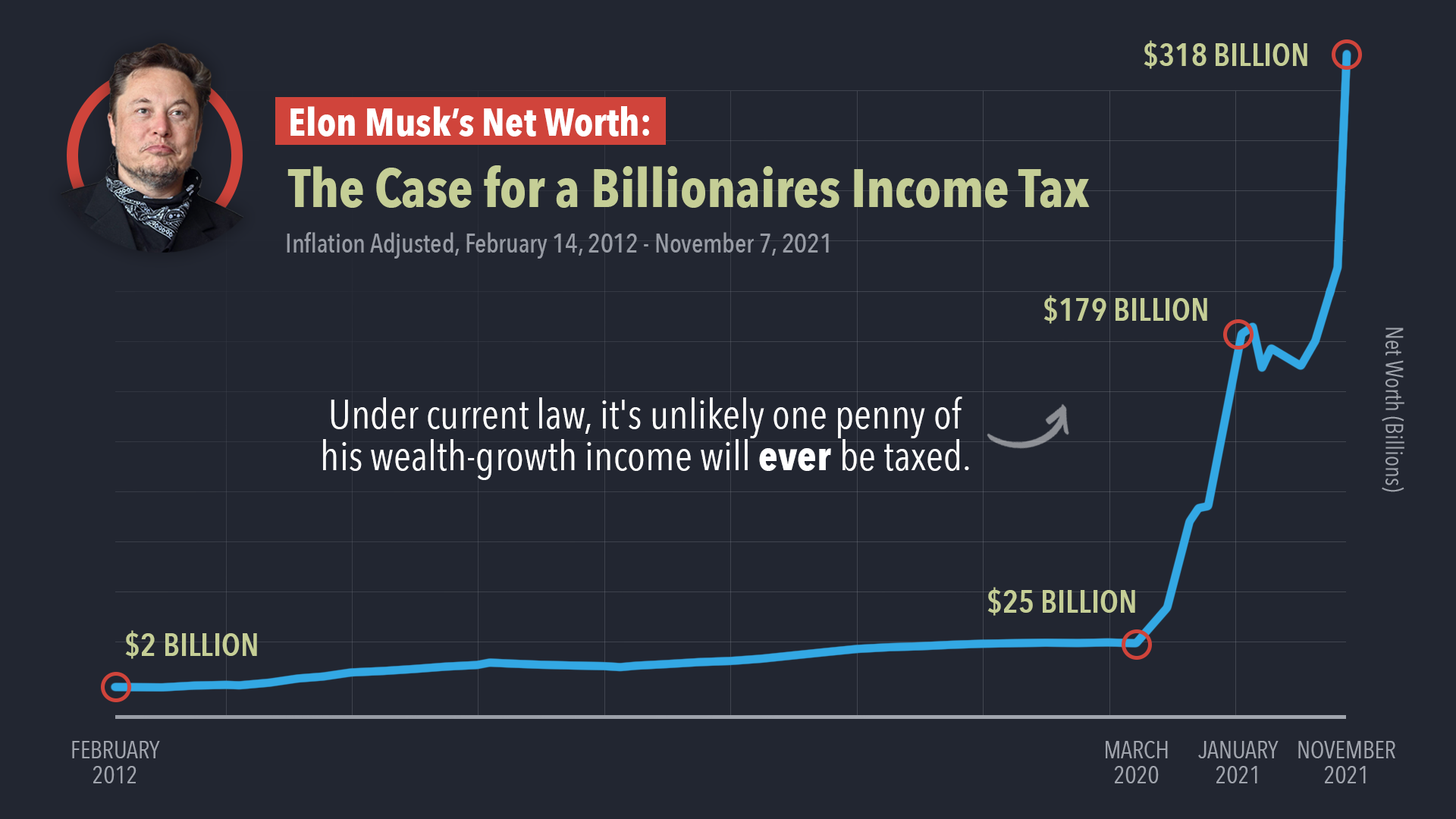

Here's where it gets a bit more complex. Between 2014 and 2018, Elon Musk's personal wealth, you know, grew by a truly staggering amount—about $13.9 billion. Yet, during that same period, he reported $1.52 billion in income and, as ProPublica found, paid a "true tax rate" of just 3.27%. This is a pretty significant gap, you see, between how much his fortune increased and how much income he declared for tax purposes.

This situation, where wealth grows immensely but reported taxable income remains relatively low, is a key part of the puzzle. It shows that, in a way, the tax system is set up to tax income, not necessarily the growth in wealth that comes from, say, the rising value of stock holdings. This is a very important distinction, as a matter of fact, when you're trying to figure out what's going on with billionaire taxes. You can learn more about ProPublica's investigations into billionaire taxes here.

How Billionaires Manage Their Taxes: Legal Strategies

So, if they're not paying income tax on their wealth growth, how exactly do billionaires manage their tax obligations? It's not about doing anything illegal; it's about using the existing legal frameworks to their advantage. These are strategies that, you know, are available to anyone with enough assets, but they're most effective for those with truly vast fortunes.

Borrowing Against Shares: A Key Method

One of the main ways people like Elon Musk manage their finances without triggering large tax bills is by borrowing money against their owned shares in companies like Tesla. This is a pretty common strategy, actually. When you borrow money, it's considered a loan, not income, so it's not taxed. This means he can access a lot of cash to fund purchases or investments without having to sell his stock and, in doing so, avoid paying taxes on that "debt" or borrowed money. It's a very clever way to get liquidity without a taxable event.

This particular method has been a sticking point for many critics. They point out that while he's borrowing against his shares to, for example, fund the purchase of a company, he isn't paying any taxes on that borrowed money. It really does feel like, you know, a significant loophole to a lot of people, especially when they consider the average person's financial situation. This is a legal financial strategy that, like, allows billionaires to circumvent what might otherwise be federal income taxes on their wealth.

The Income Tax Gap

The massive difference in tax rates between billionaires and regular Americans is a topic that, you know, generates a lot of discussion. While ordinary people primarily earn income through salaries and wages, which are taxed at a certain rate, billionaires often derive their wealth from assets like stocks, which aren't taxed until they're sold. This creates a significant gap in how different types of wealth are treated by the tax system, and it's a gap that, in a way, allows the super-rich to pay a much lower "true" tax rate on their overall wealth growth.

For instance, according to a trove of leaked IRS tax receipts, Jeff Bezos, another very wealthy individual, paid a 23.2% tax rate from 2013 to 2018. This rate is far below the top tax rate of 37% that applies to the ordinary income of high earners. This difference, you know, shows how the structure of wealth can greatly influence effective tax rates, which is something many find quite surprising.

The Public Reaction and Musk's Response

The public outcry over wealthy individuals not appearing to pay enough taxes has, you know, certainly been noticeable. This widespread concern has led to more scrutiny of how billionaires manage their money and what their actual tax contributions are. It's a conversation that, frankly, isn't going away anytime soon.

The 2021 Announcement

Following a period of significant public discussion and criticism about the rich not paying enough taxes, Elon Musk made a notable announcement. In December 2021, he stated that he expected to pay over $11 billion in taxes for that year. This amount, he suggested, would be the largest tax bill of any American in history. His personal tax obligations, you see, have really garnered a lot of attention, and this announcement was a very direct response to that public interest.

This substantial tax bill, he explained, resulted from exercising a large number of stock options, which triggered a significant taxable event. So, in this particular year, he did indeed face a hefty tax bill, possibly the biggest in U.S. history for an individual. It's important to remember, though, that this specific payment was tied to a particular financial action, not necessarily an ongoing annual income tax payment on his total wealth, you know, as it grows.

Ongoing Scrutiny

Despite his claims of a massive 2021 tax payment, the scrutiny surrounding Elon Musk's tax contributions continues. The public remains very interested in whether this was a one-time event or if it signals a change in how billionaires are taxed more generally. People, you know, are still asking questions and looking for more clarity on the overall picture of wealth and taxation. Learn more about wealth and taxation on our site, and link to this page for deeper insights into economic policies.

It's a complex issue, with legal frameworks allowing for strategies that, to many, seem to create a system where the extremely wealthy operate under different rules. The debate about whether these strategies are fair or if the tax system needs reform is, like, still very much alive and, arguably, will continue for a long time to come.

Frequently Asked Questions

Here are some common questions people often ask about Elon Musk and his taxes:

Does Elon Musk pay federal income tax?

Yes, Elon Musk does pay federal income tax, especially when he sells shares or exercises stock options, which are taxable events. However, ProPublica's analysis indicated he paid no federal income taxes in 2018, which was due to legal financial strategies available to billionaires, like borrowing against shares instead of selling them.

How do billionaires avoid paying high income taxes?

Billionaires can legally reduce their income tax obligations through various strategies. A primary method involves borrowing money against their vast stock holdings rather than selling the stock. Since loans are not considered income, they are not taxed. This allows them to access liquidity without triggering capital gains taxes on their wealth, which is, you know, a pretty effective way to manage their tax burden.

Did Elon Musk really pay $11 billion in taxes in 2021?

Elon Musk publicly claimed and tweeted in December 2021 that he expected to pay over $11 billion in taxes for that year. This substantial payment was reportedly due to exercising a large number of stock options, which generated a significant taxable income. Many sources corroborated that this was, indeed, a very large individual tax payment, possibly the largest in U.S. history for a single year.

ELON MUSK WORTH $318 BILLION: THE CASE FOR A BILLIONAIRES INCOME TAX

ELON MUSK WORTH $318 BILLION: THE CASE FOR A BILLIONAIRES INCOME TAX

How Much Taxes Does Elon Musk Pay? He REVEALS It At Code Conference