How Much Is 200k A Year Hourly? Unpacking A Significant Salary

Ever wonder what a really good annual salary like $200,000 actually looks like when you break it down by the hour? It's a question many people ponder, whether they are thinking about a career change, looking to negotiate their pay, or just trying to get a clearer picture of what a substantial income means on a day-to-day basis. Figuring out the hourly equivalent of a large yearly sum, you know, gives you a different perspective on your time and effort.

For many, a $200,000 yearly income seems like a dream, a true mark of financial success. But what does that mean for the hours you put in? It's not just about the big number; it's about understanding the real value of each hour you dedicate to your work, and how that compares to different ways of earning money. This kind of insight can, in a way, help you appreciate your earnings or perhaps even rethink your work-life balance.

So, let's pull back the curtain on this big number. We'll look at the simple math, and then we'll consider all the other pieces that make up your true hourly worth. This way, you get a complete picture, which is, to be honest, much more useful than just a single figure.

Table of Contents

- The Basic Calculation: How We Figure It Out

- More Than Just the Hourly Rate: The Bigger Picture

- Different Professions, Different Realities

- Is 200k a Year a Lot? A Closer Look

- Your Hourly Worth: Beyond the Numbers

- Making Your Money Work for You

- People Also Ask

The Basic Calculation: How We Figure It Out

When you want to know how much $200,000 a year comes out to per hour, the first thing you need is a standard number of work hours in a year. This is, you know, the starting point for pretty much any salary conversion.

Most full-time jobs assume a certain number of hours per week. This number is then multiplied by the weeks in a year to get a yearly total. It's a pretty straightforward math problem, honestly.

Standard Work Weeks: The Usual Way

The most common way to figure this out is to assume a 40-hour work week. This is, basically, what many people consider a typical full-time job. There are 52 weeks in a year, so we multiply those numbers together.

So, 40 hours a week multiplied by 52 weeks a year gives us 2,080 working hours in a year. This is the figure many calculators use, as a matter of fact.

Now, to get the hourly rate, you simply take the annual salary and divide it by these total hours. So, for $200,000 a year, divided by 2,080 hours, you get approximately $96.15 per hour. That's, you know, a pretty good hourly rate.

This calculation is, in short, the baseline. It gives you a quick snapshot of what your time is worth on a simple hourly basis before anything else is considered. It's just the gross amount, to be honest.

What About Overtime or Fewer Hours?

Not everyone works a perfect 40-hour week, do they? Some jobs, especially those that pay really well, might involve more hours. Think about demanding executive roles or certain specialized positions; they often require more time, sometimes much more.

If you work 50 hours a week, for example, your total yearly hours jump up to 2,600 (50 hours x 52 weeks). If you divide $200,000 by 2,600 hours, your hourly rate drops to about $76.92. This shows, you know, how extra hours can change the hourly perception of your pay.

On the other hand, some roles might offer a slightly shorter work week, maybe 35 hours. In that case, you're looking at 1,820 hours a year (35 hours x 52 weeks). Divide $200,000 by 1,820, and your hourly rate goes up to around $109.89. So, fewer hours actually make each hour worth more, apparently.

It's important to think about the actual hours you put in, because that really shapes your personal hourly wage. The standard 40-hour week is a good starting point, but your real experience might be quite different, in a way.

More Than Just the Hourly Rate: The Bigger Picture

While knowing the gross hourly rate is helpful, it doesn't tell the whole story of your financial situation. A $200,000 salary is a large amount, yes, but what you actually take home and what other benefits you get truly define its value. There are, you know, many pieces to this puzzle.

We need to consider things like taxes, benefits, and even where you live. These factors can significantly change how much of that $96.15 per hour you actually get to keep or use. It's, as a matter of fact, much more complex than just the initial calculation.

Taxes and Deductions: The Money That Goes Out

This is where things get a bit more involved. That $96.15 per hour is before any money is taken out for taxes and other deductions. Federal income tax, state income tax (if applicable), local taxes, Social Security, and Medicare all take a piece. These are, basically, non-negotiable deductions.

For a $200,000 salary, the percentage taken out can be quite substantial. Depending on your filing status, dependents, and where you live, you might see anywhere from 25% to 40% or even more of your gross pay go towards these deductions. This means, you know, your actual take-home hourly rate will be significantly less.

Let's say, for instance, that after all taxes and deductions, you take home 65% of your gross pay. Your $200,000 salary becomes $130,000 net. Divide that by 2,080 hours, and your hourly take-home pay is closer to $62.50. That's, obviously, a pretty big difference from the gross figure.

It's really important to look at your pay stubs and understand these deductions. They are a big part of your financial reality, and they definitely impact your effective hourly rate. You can, for example, use online calculators to get an estimate for your specific situation. You can learn more about how taxes impact your income here.

Benefits and Perks: The Hidden Value

A salary isn't just about the cash you get. Many jobs, especially those paying $200,000, come with a whole host of benefits that add significant value. These are, in a way, part of your total compensation package, and they should be factored into your hourly worth.

Think about health insurance, dental, and vision coverage. Your employer might pay a large portion, or even all, of these premiums. That's money you don't have to spend out of your pocket, which is, in fact, like getting extra pay. A good health plan can easily be worth several thousand dollars a year.

Then there's retirement savings, like a 401(k) match. If your company matches your contributions, that's free money added to your retirement fund. This can, you know, add thousands more to your overall compensation each year. It's a huge benefit, to be honest.

Other perks might include paid time off (vacation, sick days, holidays), life insurance, disability insurance, tuition reimbursement, gym memberships, or even free meals. These things, as a matter of fact, have a real monetary value, even if they don't show up in your hourly cash rate. They contribute to your overall well-being and financial security, which is, you know, pretty significant.

Cost of Living: Where You Are Matters

A $200,000 salary feels very different depending on where you live. This is, basically, a huge factor in the real value of your hourly pay. What seems like a lot in one place might be just comfortable in another.

In a high-cost-of-living city like New York City, San Francisco, or parts of California, $200,000 might cover rent, food, and basic expenses, but it might not leave a great deal for savings or luxuries. Housing costs alone can be extremely high, you know, taking a big bite out of your income.

Conversely, in a lower-cost-of-living area, that same $200,000 salary could provide a much more affluent lifestyle. Your money would, in some respects, go much further, allowing for more savings, bigger homes, or more discretionary spending. This truly impacts your quality of life, which is, you know, important.

So, while your hourly rate might be $96.15 gross, its purchasing power changes dramatically based on your location. It's, as I was saying, crucial to consider this when evaluating a salary offer or comparing your earnings to others. A high salary in a high-cost area might feel, frankly, like a lower hourly wage in practice.

Different Professions, Different Realities

A $200,000 annual salary can come from many different types of jobs, and the hourly experience can vary widely between them. For instance, a software engineer making $200,000 might work a fairly consistent 40-hour week, with good benefits and a relatively stable schedule. Their hourly reality might align pretty closely with the $96.15 gross figure, perhaps a bit more.

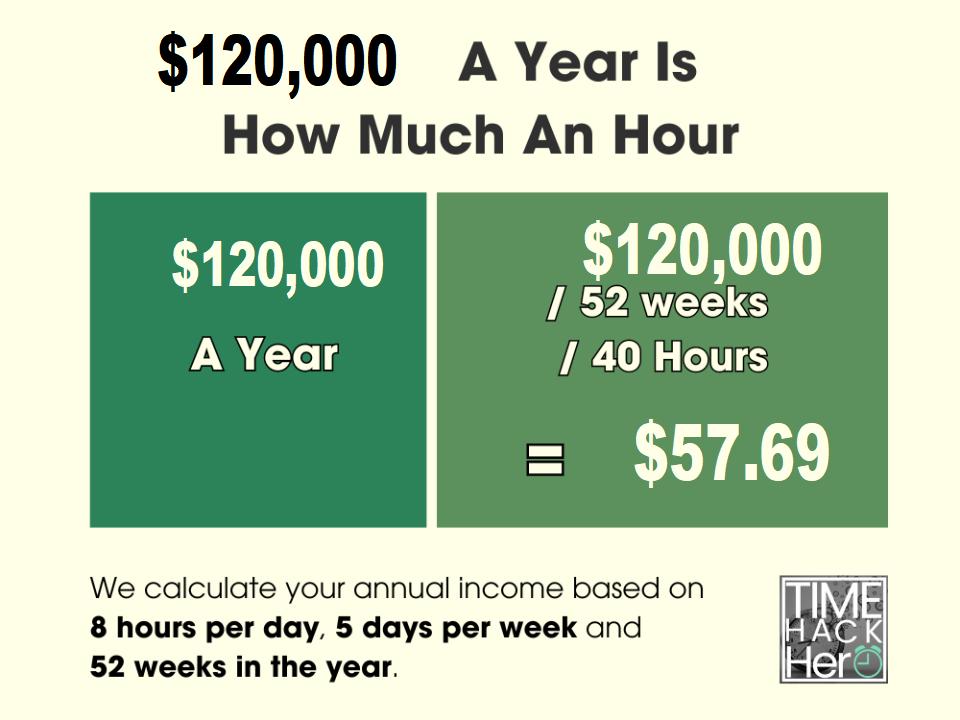

On the other hand, a highly paid consultant or a senior executive might also earn $200,000, but their work week could easily stretch to 60 or 70 hours, or even more. For them, that $200,000 salary divided by 3,000 or 3,500 hours means a much lower effective hourly rate, maybe in the $57 to $66 range. This is, you know, a very different kind of work experience.

Consider also the nature of the work. Some high-paying jobs involve intense pressure, frequent travel, or constant availability. While the pay is great, the demands on your time and personal life can be significant. This makes the true "value" of each hour different, you know, depending on what you have to give up for it.

So, when you think about "How much is 200k a year hourly?", it's not just a number; it's also about the lifestyle and demands that come with that specific job. The work environment and the actual effort required can, in a way, make a substantial difference to how you feel about your pay.

Is 200k a Year a Lot? A Closer Look

Yes, absolutely, $200,000 a year is considered a very high salary for most people in most places. It places you well into the upper income brackets in many countries, including the United States. This level of income typically allows for a very comfortable lifestyle, with room for savings, investments, and discretionary spending. It's, you know, a significant achievement.

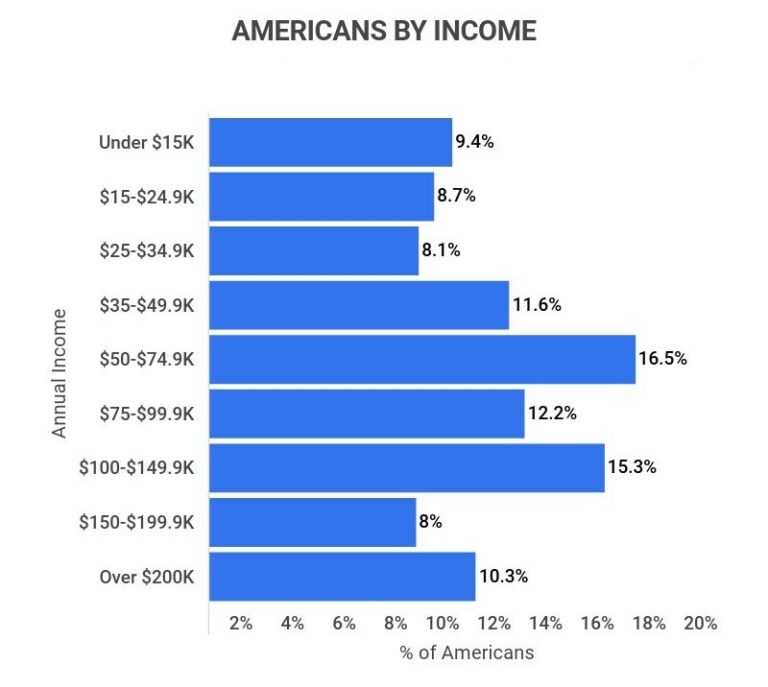

According to data from various sources, the median household income in the United States is much lower than $200,000. So, earning this amount puts you in a relatively small group of high earners. It means you have, basically, a great deal of financial flexibility compared to the average person.

However, as we've discussed, its "muchness" can vary. My text says, "The meaning of much is great in quantity, amount, extent, or degree." And it also says, "Use the adjective much to mean a lot or a large amount." So, yes, $200,000 is a large amount. But the feeling of "how much" depends on your location, your family situation, and your spending habits. For example, if you have a large family in a very expensive city, your $200,000 might feel less "much" than it would for a single person in a more affordable area. It's, to be honest, all relative.

It's also worth noting that with a higher income often comes higher expectations, both from yourself and from others. There might be more pressure, more responsibility, and perhaps even more hours. So, while the financial reward is substantial, the trade-offs can be, you know, real too.

Your Hourly Worth: Beyond the Numbers

Thinking about your hourly worth goes beyond just the dollar amount. It also involves what you gain from your work experience. Are you learning new things? Are you developing valuable skills? Is the work fulfilling? These non-monetary aspects, you know, add to your overall "hourly value."

A job that pays $200,000 might offer incredible growth opportunities, networking connections, or the chance to work on exciting projects. These are things that build your career and personal satisfaction, which is, basically, hard to put a price tag on. They make each hour you spend more valuable, in a way.

Conversely, a high-paying job that leaves you feeling drained, uninspired, or constantly stressed might, in some respects, make that high hourly rate feel less appealing. Your personal well-being is, obviously, a huge part of your overall "worth."

So, when you consider "How much is 200k a year hourly?", remember to factor in the intangible benefits and costs. The true value of your time is, you know, a mix of the money you earn and the life you live while earning it. It's about finding that balance that feels right for you.

Making Your Money Work for You

Earning $200,000 a year, or roughly $96.15 an hour gross, provides a fantastic opportunity to build real wealth. With this level of income, you have the potential to save and invest a significant portion of your earnings. This can, you know, lead to long-term financial security and freedom.

Consider setting up automatic transfers to savings and investment accounts. Even a small percentage of that $96.15 per hour, if consistently saved, can grow into a substantial sum over time. You could, for instance, contribute the maximum to your 401(k) and an IRA, and still have plenty left over.

Financial planning becomes very important at this income level. Working with a financial advisor can help you make smart choices about managing your money, minimizing taxes, and planning for retirement or other big life goals. They can help you, basically, get the most out of every hour you work.

So, while understanding the hourly breakdown is interesting, the real power of a $200,000 salary lies in how you manage it. It's about turning that high hourly earning into lasting financial well-being, which is, you know, the ultimate goal for many. Learn more about financial planning strategies on our site, and you can also find helpful information about creating a budget that works for you.

People Also Ask

What is 200k after taxes?

The amount you take home from $200,000 after taxes depends greatly on where you live and your specific tax situation. Factors like federal income tax, state income tax, local taxes, Social Security, and Medicare all reduce your gross pay. It's, you know, common for the take-home amount to be anywhere from $120,000 to $150,000 annually, or even less in very high-tax areas, after all these deductions. This means your effective hourly rate after taxes is much lower than the gross figure, obviously.

Is 200k a good salary for a single person?

Yes, absolutely, $200,000 a year is an excellent salary for a single person in most places. This level of income typically provides a very comfortable lifestyle, allowing for significant savings, investments, and discretionary spending. You would, basically, have a great deal of financial flexibility and the ability to pursue many financial goals, which is, you know, a pretty good situation to be in.

How much is 200k a year per month?

To figure out how much $200,000 a year is per month, you simply divide the annual salary by 12. So, $200,000 divided by 12 months equals approximately $16,666.67 per month. This is, in short, a very substantial monthly income, allowing for a good standard of living, to be honest.

How to Make 200k a Year – 2023 GUIDE - Roostervane

$200K a Year Is How Much an Hour? | OysterLink

$120000 a Year is How Much an Hour? Before and After Taxes