What Is 40 An Hour Annually? Your Guide To Understanding Your Yearly Earnings

Figuring out your yearly earnings from an hourly wage can, you know, sometimes feel like a bit of a puzzle. It's a really common question for many people, especially when you're thinking about a new job or just trying to get a better handle on your personal finances. Knowing what "40 an hour annually" truly means for your wallet is pretty important for planning your life, so, like, understanding this conversion is a big deal for anyone managing their money.

Many folks, you see, get paid by the hour, and it's quite natural to wonder how that translates into a bigger picture of what you bring home each year. This is that kind of information that helps you see your income in a broader way, which, to be honest, can be very helpful for budgeting and making future plans. It's not just about the immediate paycheck; it's about the bigger financial story.

The exact yearly amount can, as a matter of fact, shift just a little depending on how many weeks you actually put in during a year. We'll look at the typical ways this calculation works and what those numbers might mean for you. It's all about getting a clearer picture of your money, anyway.

Table of Contents

- The Basic Calculation: 40 Hours a Week, 50 Weeks a Year

- Why 52 Weeks Makes a Difference

- Breaking Down the Numbers: How We Get There

- Is $40 an Hour a Good Wage?

- From Annual Back to Hourly: The Reverse Calculation

- Factors That Shape Your Actual Take-Home Pay

- Making the Most of Your $40 an Hour Income

- Common Questions About Hourly Pay

The Basic Calculation: 40 Hours a Week, 50 Weeks a Year

When you hear about an hourly wage like $40, people often wonder what that means for their total yearly income. A common way to figure this out, as a matter of fact, is by assuming a standard work schedule. This typically means working 40 hours every week, and then taking a couple of weeks off throughout the year, so you end up working 50 weeks.

Based on this usual setup, where you work 40 hours a week for 50 weeks, a $40 hourly wage comes out to about $80,000 each year. This is a pretty straightforward way to get a general idea of your annual earnings. It's a quick estimate that many people use, you know, to get a rough sense of their financial standing.

This calculation is quite simple to do, too. You just multiply your hourly rate by the number of hours you work each week, and then multiply that by the number of weeks you work in a year. So, $40 per hour times 40 hours per week, then times 50 weeks, equals $80,000. It's a good starting point, basically, for understanding your potential income.

For many, this $80,000 figure is what they first think of when they consider a $40 hourly rate. It gives a clear picture of what a typical full-time schedule might bring in over a year. This amount, to be honest, can be a comfortable income for many households, depending on where they live and their personal needs.

It's important to keep in mind that this specific calculation accounts for those two weeks of, you know, unpaid time or vacation that isn't counted as work weeks. So, if you're planning your budget or thinking about a job offer, this $80,000 number is often the first one that comes to mind. It's a useful benchmark, really.

Why 52 Weeks Makes a Difference

While the 50-week calculation is common, some people actually work all 52 weeks in a year, or their paid time off is included in their annual salary calculation. When you work all 52 weeks, the annual income for a $40 hourly wage goes up a bit. This is because there are two extra weeks of pay being added into the total, you know, which certainly adds up.

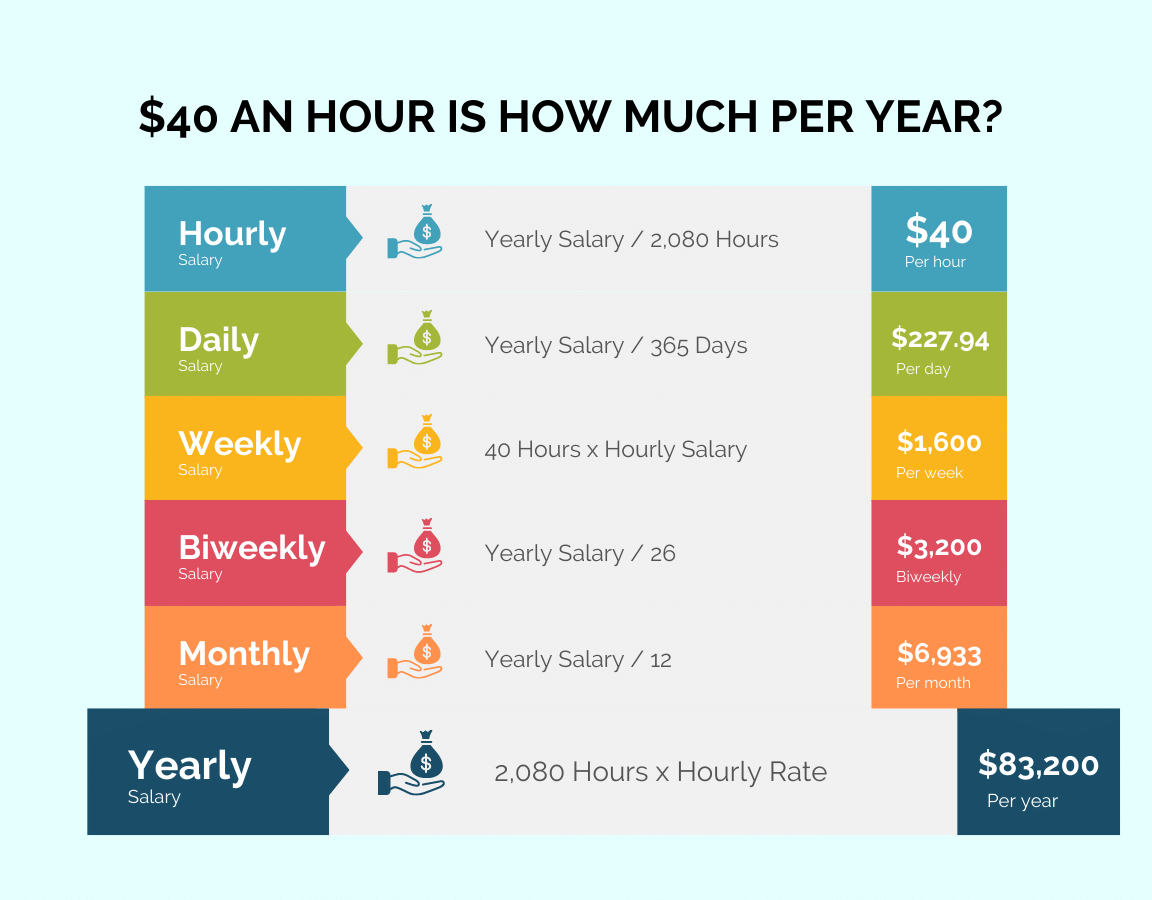

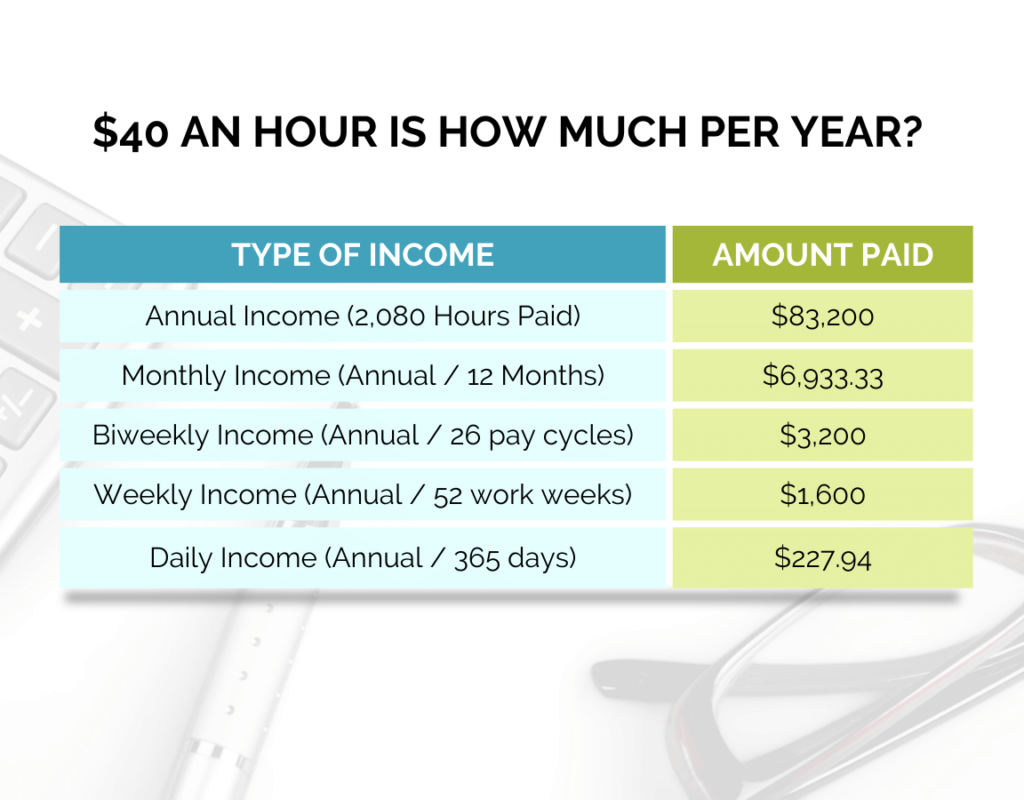

If you earn $40 per hour and work a full 40 hours per week for all 52 weeks of the year, your annual income comes to $83,200. This is a slightly higher figure than the $80,000 we talked about earlier. The difference, you see, is just those two additional weeks of work, which can make a noticeable impact on your yearly total.

This calculation assumes a standard work schedule of 40 hours weekly throughout the entire year, without any unpaid breaks. So, if you earn $40 per hour, work 40 hours per week, and 52 weeks per year, your annual salary would be $83,200. It's a pretty simple adjustment, but it changes the final number, anyway.

The distinction between 50 and 52 weeks is pretty important when you're looking at job offers or trying to compare different pay structures. Some roles might factor in paid holidays and vacation time into a 52-week calculation, making the $83,200 figure more accurate for those situations. It's a good thing to clarify, you know, when you're discussing your pay.

Knowing this slight variation can help you get a more precise picture of your potential yearly income. It shows that even a small change in the number of weeks worked can, in some respects, lead to a different overall sum. So, it's worth considering whether your job assumes 50 or 52 working weeks when you're doing your calculations, basically.

Breaking Down the Numbers: How We Get There

To really get a feel for how these annual figures are reached, it's helpful to look at the math involved. It's not too complicated, really, and it helps make sense of where the $80,000 or $83,200 numbers come from. Understanding the simple steps makes the whole process very clear.

The 2,080 Hour Standard

A key number in converting hourly wages to annual salaries is 2,080. This number represents the typical total hours worked in a year for someone on a full-time schedule, assuming 40 hours per week for 52 weeks. It's a standard figure used in many salary calculations, actually, so it's good to know.

To decide your hourly salary if you know your annual income, you can divide your annual income by 2,080. For example, if you make a hundred thousand dollars in 12 months, your hourly wage is $100,000 divided by 2,080, which works out to about $48.07 per hour. This shows how you can move from a yearly sum back to an hourly rate, you know, which is quite useful.

Conversely, to calculate your annual salary from an hourly wage, you simply multiply your hourly rate by 2,080. So, if you make $40 an hour, your yearly salary would be $40 times 2,080, which equals $83,200. This calculation assumes that you work 40 hours a week, every week, throughout the entire year. It's the most direct conversion, in a way.

This 2,080-hour standard is widely accepted because it accounts for all the weeks in a year, including any paid holidays or vacation time that is part of a salaried position. It provides a consistent baseline for converting hourly pay to an annual figure, and vice versa. It's a pretty reliable number, basically, for these types of financial calculations.

Understanding where the 2,080 comes from helps demystify salary conversions. It's not just an arbitrary number; it's the product of a typical full-time work year. So, when you're thinking about your pay, this number is, like, a really helpful tool to have in your mind.

A Quick Look at Monthly Earnings

Once you have your annual salary figured out, it's often helpful to break that down into monthly amounts. This can make budgeting and planning your regular expenses much easier to manage. It gives you a clearer picture of what you have to work with each month, you know, which is quite practical.

To calculate your monthly salary, you simply divide your annual salary by 12, since there are 12 months in a year. So, if your annual salary is $83,200, your monthly income would be $83,200 divided by 12, which comes out to about $6,933.33 per month. This calculation assumes a standard work schedule of 40 hours weekly throughout the year, as discussed.

For those earning $80,000 annually (based on 50 weeks of work), their monthly income would be $80,000 divided by 12, which is about $6,666.67 per month. Both figures give you a good idea of your regular income flow. It's pretty straightforward, really, and helps with everyday financial planning.

Knowing your monthly income is very important for setting up a budget and tracking your spending habits. It helps you see how much money is coming in versus how much is going out on a regular basis. This kind of detail, you know, is really helpful for maintaining financial stability and reaching your savings goals.

So, whether you're looking at $83,200 or $80,000 annually, dividing by 12 gives you that monthly figure that's so useful for day-to-day money management. It just makes things a little more tangible, actually, for your personal financial situation.

Is $40 an Hour a Good Wage?

Many people wonder if $40 an hour is considered a good wage. The answer to that question can, in some respects, vary quite a bit depending on where you live and what your personal financial needs are. What might be comfortable in one area could be a bit tighter in another, you know, due to differences in living costs.

At $40 per hour, which translates to about $83,200 annually, this wage is generally well above average for most parts of the United States. This means that for a good number of people, this income level provides a solid foundation for a comfortable life. It's a pretty strong earning potential, actually, for many types of jobs.

This salary can provide a comfortable living in most areas, though the cost of living varies significantly across different regions. In places with lower living expenses, $83,200 a year could allow for significant savings and a higher quality of life. In very expensive cities, however, it might feel more like a modest income, you know, compared to what's needed there.

So, while the numerical value of $40 an hour is quite good on its own, its real value is, like, pretty tied to your specific location. It's always a good idea to research the cost of living in your area when you're evaluating a salary. This helps you understand what that income truly means for your purchasing power and lifestyle.

Generally speaking, $40 an hour is a strong wage that offers good financial stability for many. It often allows for more than just covering basic needs, potentially providing room for savings, investments, and some discretionary spending. It's a pretty positive sign, basically, for your earning potential.

Considering the US Average

When we think about whether $40 an hour is a good wage, it's helpful to compare it to the average earnings across the United States. This gives us a broader context for what most people are making. Looking at the bigger picture can, you know, help you gauge your own financial standing.

As mentioned, an hourly wage of $40, translating to around $83,200 annually, is quite a bit higher than the median household income in the U.S. This suggests that someone earning $40 an hour is, like, in a pretty good position compared to many other workers. It's a wage that stands out, actually, in the overall economic landscape.

This higher-than-average income often means more financial flexibility. It can allow for better housing options, more reliable transportation, and the ability to save for future goals. It's a level of income that typically provides a good amount of financial security for an individual or a household, basically.

It's worth noting that average income figures can vary based on factors like industry, education, and experience. However, across a wide range of professions, $40 an hour is a respectable wage. It shows a certain level of skill or demand in the job market, anyway, that commands a higher rate of pay.

So, from a national perspective, making $40 an hour puts you in a relatively strong economic position. It's a wage that generally allows for a comfortable lifestyle and the ability to pursue various financial aspirations. This is, you know, a pretty encouraging figure for many people.

The Impact of Living Costs

While $40 an hour is a good wage in many places, its true buying power is heavily influenced by the cost of living in your specific location. What might be a generous income in a smaller town could feel just adequate in a very expensive city. It's a really important factor to consider, actually, when evaluating your pay.

In areas with lower housing costs, cheaper transportation, and more affordable goods and services, $83,200 a year can go a long way. You might find it easier to save money, pay off debts, or enjoy more discretionary spending. Your money, you know, just stretches further in these places.

Conversely, in major metropolitan areas or popular coastal cities, the same $83,200 might feel considerably less. Rent, groceries, and everyday expenses can be significantly higher, meaning a larger portion of your income goes towards basic necessities. It's a bit of a different financial picture, really, in these high-cost regions.

For instance, if rent consumes a much larger percentage of your income, then even a good salary might leave less for other things. This is why it's so important to look beyond just the hourly rate and consider the overall economic environment where you reside. It's about your actual purchasing power, basically.

So, when you're assessing if $40 an hour is "good" for you, think about your local housing market, transportation costs, and general consumer prices. This personalized view gives you the most accurate sense of what your income truly provides. It's a very practical way to look at your earnings, anyway.

From Annual Back to Hourly: The Reverse Calculation

Sometimes, you might know a yearly salary and want to figure out what that translates to on an hourly basis. This can be useful if you're comparing a salaried job offer to an hourly one, or just trying to understand your current pay in a different way. It's a pretty common conversion to make, you know, in the world of work.

To convert an annual salary back to an hourly wage, you typically divide the annual income by the standard number of working hours in a year. As we discussed, that standard number is often 2,080 hours, assuming 40 hours per week for 52 weeks. It's a straightforward division, actually, that gives you a clear hourly rate.

For example, if you were offered an annual salary of $100,000, and you wanted to know what that means per hour, you would divide $100,000 by 2,080. This calculation shows your hourly wage would be about $48.07. This helps you compare it directly to an hourly job that might pay, say, $40 an hour. It's a useful comparison tool, basically.

This method allows you to break down a large yearly sum into smaller, more digestible hourly units. It can help you appreciate the value of your time and work on a per-hour basis. It's a pretty practical way to look at your compensation, anyway, and helps in making informed decisions about your career path.

So, whether you're starting with an hourly rate and going to annual, or the other way around, the math is quite consistent. Understanding both directions of the calculation gives you a more complete picture of your earnings. This knowledge is, like, very empowering for managing your financial life.

Factors That Shape Your Actual Take-Home Pay

While we've talked about what $40 an hour is annually in pretax dollars, your actual take-home pay will be a bit different. There are several things that get subtracted from your gross income before it lands in your bank account. These factors, you know, are very important to consider for your personal budget.

Taxes and Deductions

The biggest reduction from your gross pay will typically be taxes. This includes federal income tax, state income tax (if your state has one), and payroll taxes like Social Security and Medicare. These are mandatory deductions that everyone pays, basically, and they take a chunk out of your earnings.

The amount of tax you pay depends on several things, such as your total income, your filing status, and any deductions or credits you qualify for. It's not a fixed percentage for everyone, so your personal tax situation will affect your net pay. This is, you know, a pretty complex area, but important to be aware of.

Beyond taxes, you might also have other deductions from your paycheck. These could include contributions to a retirement plan, like a 401(k), or payments for health insurance premiums. These are often voluntary deductions that you choose, anyway, but they still reduce your take-home amount.

Understanding these deductions is crucial for budgeting, because your gross annual salary isn't what you'll actually have available to spend. It's important to look at your pay stub to see what's being withheld. This gives you a realistic picture of your disposable income, actually, which is very helpful for financial planning.

So, while $83,200 is your pretax income, your actual usable income will be less once all these deductions are applied. It's a key distinction to remember when you're planning your finances. This is, like, a very practical piece of information for anyone managing their money.

Overtime and Extra Hours

For hourly workers, there's also the possibility of earning more than the calculated annual salary through overtime or extra hours. If your job offers the chance to work beyond the standard 40 hours a week, those additional hours can significantly boost your total income. This is, you know, a pretty common way for hourly workers to increase their earnings.

Overtime pay is often at a higher rate, typically one and a half times your regular hourly wage. So, if you work 50 hours in a week instead of 40, those extra 10 hours would be paid at $60 an hour ($40 x 1.5). This can, as a matter of fact, add up very quickly over the course of a year, leading to a much higher annual income than the base calculation suggests.

However, relying on overtime for a consistent income isn't always predictable, as it depends on the needs of your employer and your ability to work those extra hours. It's a good bonus, basically, but not something you can always count on for your regular budget. It's more of a variable income source, anyway.

Some jobs might offer regular opportunities for extra shifts or projects, while others might have very limited overtime. It's something to consider when you're looking at hourly positions. If you're willing and able to work more, it can definitely increase your yearly take-home pay. This is, like, a very direct way to earn more money.

So, while the base $80,000 or $83,200 is a good starting point, remember that your actual earnings could be higher if you consistently work overtime. It's a factor that gives hourly pay a certain amount of flexibility in terms of income potential. This is, you know, a pretty important detail for many hourly employees.

Paid Time Off and Holidays

Another factor that shapes your actual annual income, especially when comparing different jobs, is how paid time off (PTO) and holidays are handled. Some jobs offer generous PTO, while others might provide very little, or even none for hourly roles. This can, you know, affect your overall yearly earnings in a subtle but important way.

If your job includes paid holidays and vacation time, those hours are typically counted as part of your 40-hour work week, meaning you get paid for them even when you're not physically working. This contributes to the 52-week calculation of $83,200 annually, as those weeks are still paid. It's a valuable benefit, actually, that adds to your total compensation.

On the other hand, if your job does not offer paid time off, and you take two weeks off, then you might only be paid for 50 weeks, leading to the $80,000 annual figure. This means those weeks off are unpaid, which reduces your total yearly income. It's a bit of a difference, really, in how your time away from work impacts your pay.

Understanding the company's policy on paid time off is important when you're evaluating an hourly wage. It's not just about the hourly rate itself, but also about how many of those hours throughout the year you're actually paid for. This is, like, a very practical consideration for your financial planning.

So, when you're thinking about "What is 40 an hour annually?", remember to ask about PTO and paid holidays. These benefits can significantly impact your total yearly earnings and overall job satisfaction. It's a pretty key detail, basically, that influences your financial picture.

Making the Most of Your $40 an Hour Income

Earning $40 an hour, which translates to a substantial annual income, provides a great foundation for financial stability and growth. With this kind of earning potential, there are many opportunities to manage your money wisely and build for the future. It's a very positive position to be in, you know, for your personal finances.

One good step is to create a clear budget. Knowing how much money is coming in each month and where it's going out can help you make smart choices about spending and saving. This helps you keep track of your money, basically, and ensures you're not overspending in any areas. It's a pretty fundamental part of financial health.

Consider setting financial goals, like saving for a down payment on a home, building an emergency fund, or investing for retirement. With an income of $80,000 to $83,200 annually, you have a good capacity to put money aside for these important objectives. It's a very encouraging amount for long-term planning, actually.

Exploring options for saving and investing can also be very beneficial. Even small, regular contributions can grow significantly over time thanks to the power of compounding. Learning more about personal finance strategies on our site can help you make informed decisions about your money. It's a good way to make your money work harder for you, anyway.

Also, think about how your income can support your lifestyle goals. Whether it's travel, hobbies, or further education, a solid income like $40 an hour can help you achieve these aspirations. It's about balancing your current enjoyment with future security, you know, which is a key part of financial well-being.

Remember that managing your money is a continuous process. Regularly reviewing your budget and financial goals can help you stay on track and adjust as your life circumstances change. You can also link to this page for more tips on budgeting. It's a journey, basically, that involves ongoing attention and smart choices.

For more general information on average wages and economic data, you might find resources from the Bureau of Labor Statistics quite helpful. They offer a lot of insights into different industries and pay scales across the

$40 an Hour is How Much a Year? | How To FIRE

$40 An Hour Is How Much A Year? (Gross & Net Income)

$40 an Hour is How Much a Year? | How To FIRE