Understanding How Much Taxes Does Dak Prescott Pay?

Have you ever stopped to think about the financial lives of professional athletes, especially someone like Dak Prescott? It's pretty interesting, isn't it? When we hear about their massive contracts, it's easy to picture them with endless amounts of money. But, like everyone else, they have responsibilities, and a very big one is paying their share to the government. This really gets people curious about how much taxes does Dak Prescott pay, and it's a question that comes up quite often.

It's not just a simple number, you know. The amount of money Dak takes home after all the deductions is a lot less than his reported salary. This is true for anyone with a significant income, but it's especially noticeable for those earning such a great quantity, like top-tier athletes. They face a complex web of taxes that can feel a bit overwhelming to think about.

So, what does it actually mean for someone earning a truly large amount of money? Well, we are going to explore the different kinds of taxes that chip away at a high earner's income. It's not just federal income tax; there are state taxes, local taxes, and even special taxes that apply to athletes. Understanding this gives us a much clearer picture of their financial world, and it's quite a lot to consider.

Table of Contents

- Dak Prescott: A Brief Look

- The Big Picture: High-Income Taxes

- Deductions and Write-Offs for Athletes

- Understanding Dak Prescott's Earnings

- Factors That Change Tax Amounts

- Frequently Asked Questions

- A Final Thought on High Earner Taxes

Dak Prescott: A Brief Look

Before we get into the details of how much taxes does Dak Prescott pay, it's helpful to know a little about him. He's a very well-known quarterback for the Dallas Cowboys, and he's had a rather successful career so far. His performance on the field has led to some really substantial contracts. These contracts, as a matter of fact, put him among the highest-paid athletes in the world.

Knowing his background helps us appreciate the scale of the financial figures we are talking about. He's not just a player; he's a significant financial entity. This means his earnings are a large amount, and consequently, his tax obligations are also a great quantity. It's all part of being a high-profile sports figure in today's world.

Personal Details and Bio Data

| Detail | Information |

|---|---|

| Full Name | Dakota Rayne Prescott |

| Born | July 29, 1993 |

| Birthplace | Sulphur, Louisiana |

| Position | Quarterback |

| Team | Dallas Cowboys |

| College | Mississippi State |

| NFL Draft | 2016, Round 4, Pick 135 |

| Current Status | Active NFL Player |

The Big Picture: High-Income Taxes

When someone earns a truly large amount of money, like Dak Prescott, their tax situation becomes quite involved. It's not just a single tax, but a combination of several different kinds. Each one takes a piece of the pie, so to speak. Understanding these different parts is key to figuring out how much taxes does Dak Prescott pay, or any other high earner, for that matter.

The tax system in the United States is progressive, meaning the more money you make, the higher percentage you pay in taxes. This is a fundamental concept to grasp. For someone earning a substantial extent of money, like Dak, this means they fall into the very top tax brackets. This is certainly something to keep in mind.

Federal Income Tax Brackets

The largest portion of anyone's tax bill, especially for a high earner, typically comes from federal income tax. The United States government sets up different tax brackets, and each bracket has a different percentage rate. For the highest earners, a very significant portion of their income falls into the top federal tax bracket. This means a great quantity of their earnings is taxed at the highest possible rate.

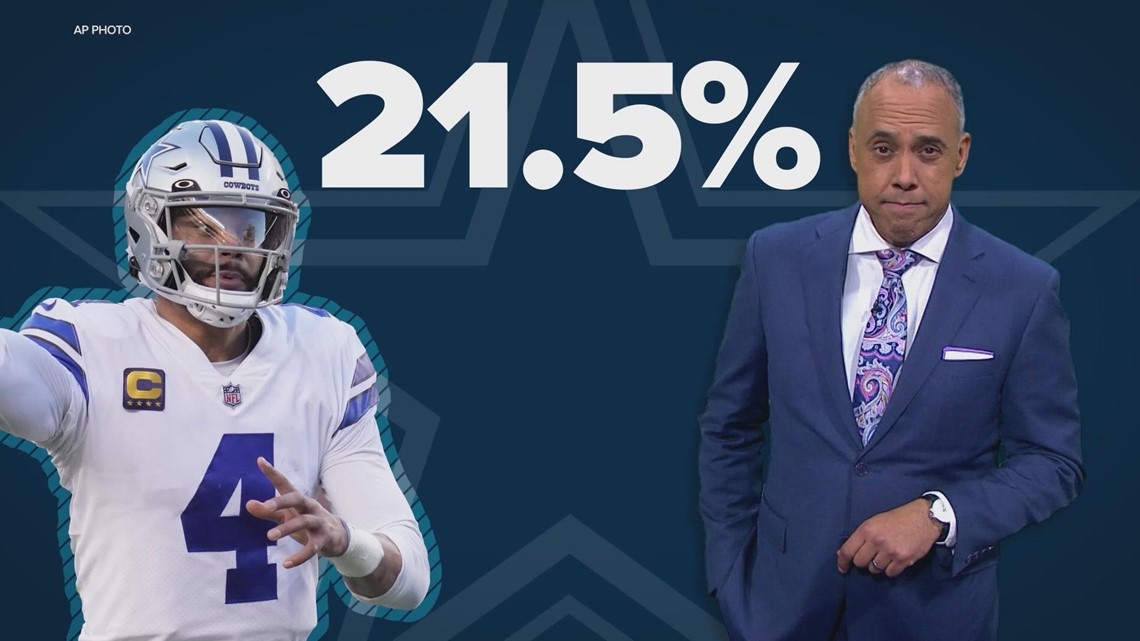

As of today, the top federal income tax rate is 37% for single filers earning over a certain amount, which is a lot. Dak Prescott's income is far, far above that threshold, so a considerable chunk of his earnings is subject to this rate. It's not simply 37% of his entire salary, though; it's a marginal tax system. This means different parts of his income are taxed at different rates. So, you know, it's not a flat rate.

For instance, the first bit of his income might be taxed at 10%, the next bit at 12%, and so on, until the largest part reaches that 37% mark. This is how the system works for everyone, but the sheer size of Dak's income means a much larger proportion of his money gets taxed at those higher rates. This is a key point when considering how much taxes does Dak Prescott pay.

State and Local Taxes

Beyond federal taxes, state income taxes also play a big part. This is where things get a bit more interesting for athletes. Texas, where the Dallas Cowboys play, is one of the few states that does not have a state income tax. This is a pretty big benefit for Dak Prescott and other Texas-based athletes, actually. It means they avoid a potentially large state tax bill on their home earnings.

However, it's not quite that simple. Even without a state income tax in Texas, athletes still pay state income taxes in other states where they play games. This is called the "jock tax," which we will discuss more in a moment. So, while his home state offers a break, his travel schedule means he still faces state taxes elsewhere. This adds a layer of complexity to figuring out how much taxes does Dak Prescott pay.

Local taxes, such as city taxes, are less common for NFL players, as most teams are not located in cities with a separate city income tax. Still, it's another potential layer of taxation to consider for high earners generally. For Dak, the absence of state income tax in Texas is a notable advantage, and that's something to remember.

The "Jock Tax": What is It?

The "jock tax" is a rather unique aspect of athlete taxation. It refers to the income tax that professional athletes pay to states and cities where they play games, even if they don't live there. So, when the Cowboys play an away game in, say, California or New York, Dak Prescott earns a portion of his income in that state. That portion then becomes subject to that state's income tax laws. This is a very specific kind of tax, and it certainly adds to the overall amount.

The calculation for this tax is usually based on the number of "duty days" an athlete spends in a particular state. A duty day includes game days, practice days, and travel days. So, if Dak spends three days in California for a game, a percentage of his total yearly income, proportionate to those three days, is then taxable by California. This means he pays income tax to many different states throughout the year. It's a rather intricate system, to be honest.

This "jock tax" can accumulate to a very significant amount, adding considerably to the overall tax burden for athletes. It's one of the primary reasons why calculating how much taxes does Dak Prescott pay is not a straightforward task. Every away game adds another layer of tax calculation, and that's a lot of layers.

Deductions and Write-Offs for Athletes

Just like regular people, high earners like Dak Prescott can take advantage of various deductions and write-offs. These reduce their taxable income, meaning they pay taxes on a smaller amount of money. For athletes, these can include business expenses related to their profession. This is a very important part of managing their overall tax bill.

Examples of such deductions might include agent fees, training expenses, equipment costs, and travel expenses not covered by the team. These can add up to a substantial extent. While these deductions help reduce the taxable income, they don't eliminate the fact that a great quantity of his earnings is still subject to high tax rates. It just means the amount he pays tax on is a little less.

Financial advisors who work with athletes are very skilled at finding these legitimate deductions. Their goal is to ensure the athlete pays only what is legally required, no more. This is a crucial service for someone managing such a large income. So, in a way, these deductions are a small silver lining in a very complex tax cloud.

Understanding Dak Prescott's Earnings

When we talk about how much taxes does Dak Prescott pay, we first need to consider his actual earnings. His reported contract value is a gross amount, meaning it's before any taxes or deductions. His actual take-home pay, or net income, is significantly less. This is a common point of confusion for many people.

For instance, a contract might be worth hundreds of millions over several years. But this money is paid out over time, and a large portion of each payment goes directly to taxes. It's not like he gets a giant lump sum and then pays taxes on it all at once. It's a continuous process, with money being withheld from each paycheck. This is how it typically works for most people, but on a much larger scale.

His income also comes from various sources. There's his base salary from the team, signing bonuses, roster bonuses, and performance incentives. Each of these can have slightly different tax treatments, which further complicates the overall picture. So, you know, it's not just one big number.

Furthermore, Dak Prescott likely has endorsement deals with various brands. These are separate income streams, and they are also subject to taxes. The total amount of money he brings in from all sources is a truly large sum, which means the amount of taxes he owes is also a very substantial extent. This is a significant consideration when trying to figure out how much taxes does Dak Prescott pay.

Factors That Change Tax Amounts

The exact amount of taxes Dak Prescott pays changes from year to year. Several factors influence this. One big factor is his total income for that specific year. If he receives a large signing bonus in one year, his taxable income for that year will be much higher, and consequently, his tax bill will be a greater quantity.

Another factor is changes in tax laws. Tax rates and rules can be adjusted by the government, which directly impacts how much taxes are owed. These changes can be minor or quite significant, and they are something high earners and their financial teams always monitor. This is, in a way, a constant adjustment.

His personal financial situation also plays a role. Things like charitable contributions, investments, and other personal deductions can influence his overall taxable income. These are personal choices that can have a very real impact on his final tax obligations. So, you know, it's not just about his football salary.

The number of away games and the states where those games are played also matter for the "jock tax." A season with more games in high-tax states will mean a larger overall tax burden from those specific state income taxes. This is a very dynamic situation, and it changes quite a bit from one season to the next.

Understanding these variables helps us see that there isn't one fixed answer to how much taxes does Dak Prescott pay. It's a moving target, influenced by many different elements. This complexity is why financial planning is so important for individuals with such a large amount of income. You can learn more about tax planning strategies on our site, and also check out this page for more insights into high earner finances.

Frequently Asked Questions

People often have many questions about how high earners like Dak Prescott handle their money and taxes. Here are some common ones that come up.

Does Dak Prescott pay state income tax?

While Dak Prescott plays for the Dallas Cowboys in Texas, which does not have a state income tax, he still pays state income tax in other states. This happens when the Cowboys play away games in states that do have an income tax. This is part of what is known as the "jock tax." So, in a way, he pays state income tax in many different places throughout the year, but not in his home state.

What percentage of an NFL player's salary goes to taxes?

The exact percentage varies greatly depending on the player's total income, their home state, and the states where they play games. However, for top-tier players like Dak Prescott, it's common for a very substantial portion of their gross salary to go towards federal, state, and local taxes. This can easily be more than 40% or even higher, once you factor in all the different tax obligations. It's a truly large amount that gets taken out.

Do athletes pay taxes on signing bonuses?

Yes, athletes absolutely pay taxes on signing bonuses. A signing bonus is considered taxable income in the year it is received. For a player like Dak Prescott, a signing bonus can be a very large sum, and it is subject to federal income tax, and potentially state income tax depending on where he is considered to be earning that income. This means a great quantity of that bonus goes directly to taxes.

A Final Thought on High Earner Taxes

Understanding how much taxes does Dak Prescott pay really shows us the extensive financial commitments of professional athletes. It's a complex picture, certainly, with federal taxes, state taxes, and the specific "jock tax" all playing a part. The amount of money involved is truly great in quantity, measure, and degree, which means the taxes are also very substantial.

It's not just about the big numbers we see in headlines. It's about the intricate system that manages such a large amount of income. For anyone earning a significant amount, like Dak, managing these tax obligations requires careful planning and expert advice. It's a continuous process, and it's a very real part of their financial lives. This insight, you know, helps us appreciate the full scope of their earnings and responsibilities.

This perspective offers a much clearer view of the financial realities for those at the very top of their professions. It shows that even with a very large amount of money, a significant portion goes towards supporting public services through taxes. This is a general truth for anyone with a high income, and it's a topic that always generates a lot of interest. For more general information on taxation in the United States, you might find this resource helpful: Internal Revenue Service (IRS).

How much does Dak Prescott's salary affect Dallas Cowboys' cap? | wfaa.com

Dak Prescott’s Net Worth, Salary, Contract, and Career Earnings: How

Dak Prescott's 2021 salary, how much will he earn?